As the weather warms up and we shake off the winter chill, spring brings a fresh opportunity to refocus on your health and wellbeing.

It’s almost tax time – and this could impact you if you’ve hit the magical age of 31 or if your earnings are creeping past the $90,000 per year mark. This is due to the government’s “stick and carrot” approach to private health insurance.

Born between 1 July 1989 and 30 June 1990?

You’ve reached a critical age for private hospital cover. This is the age at which the Australian Government applies a levy – called Lifetime Health Cover (LHC) loading - on top of your premium if you put off getting private hospital insurance until you’re older.

LHC loading increases your premiums by 2% for each year you are over 30. For example, if you wait until you’re 40, you could pay an extra 20% on the cost of your hospital cover. If you wait until you’re 50, you could pay 40% more, and so on, up to a maximum of 70%.

To avoid paying the loading, you’d need to get hospital cover by 1 July following your 31st birthday.

Moving up the earnings ladder?

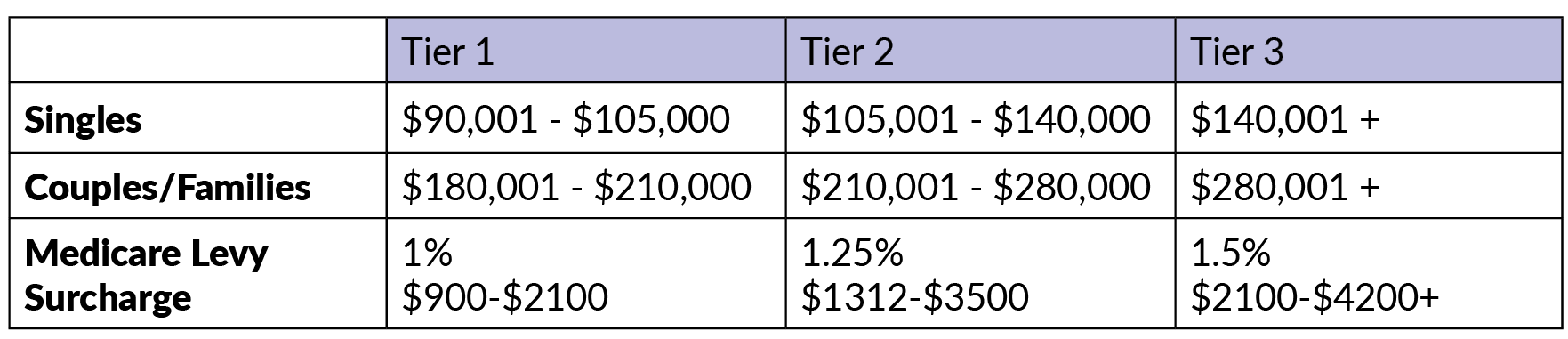

As your income starts to grow, you may be liable to pay an extra Medicare levy if you don’t have private hospital cover.

Depending on your income and personal circumstances, you could pay from $900 to over $4200 per year in extra tax, as the table below shows.

Medicare Levy Surcharge

Even taking out a basic hospital cover will save you from paying this extra tax – and you may even qualify for a rebate on your premiums from the government to help you pay for it.

Right now’s a great time to consider taking out private health insurance with Union Health – an Aussie health fund that delivers affordable health insurance cover to past and present union members and their families. We’re 100% member-owned and all about your health, not shareholders’ wealth.

Discuss your health cover today!